Fica tax withholding calculator

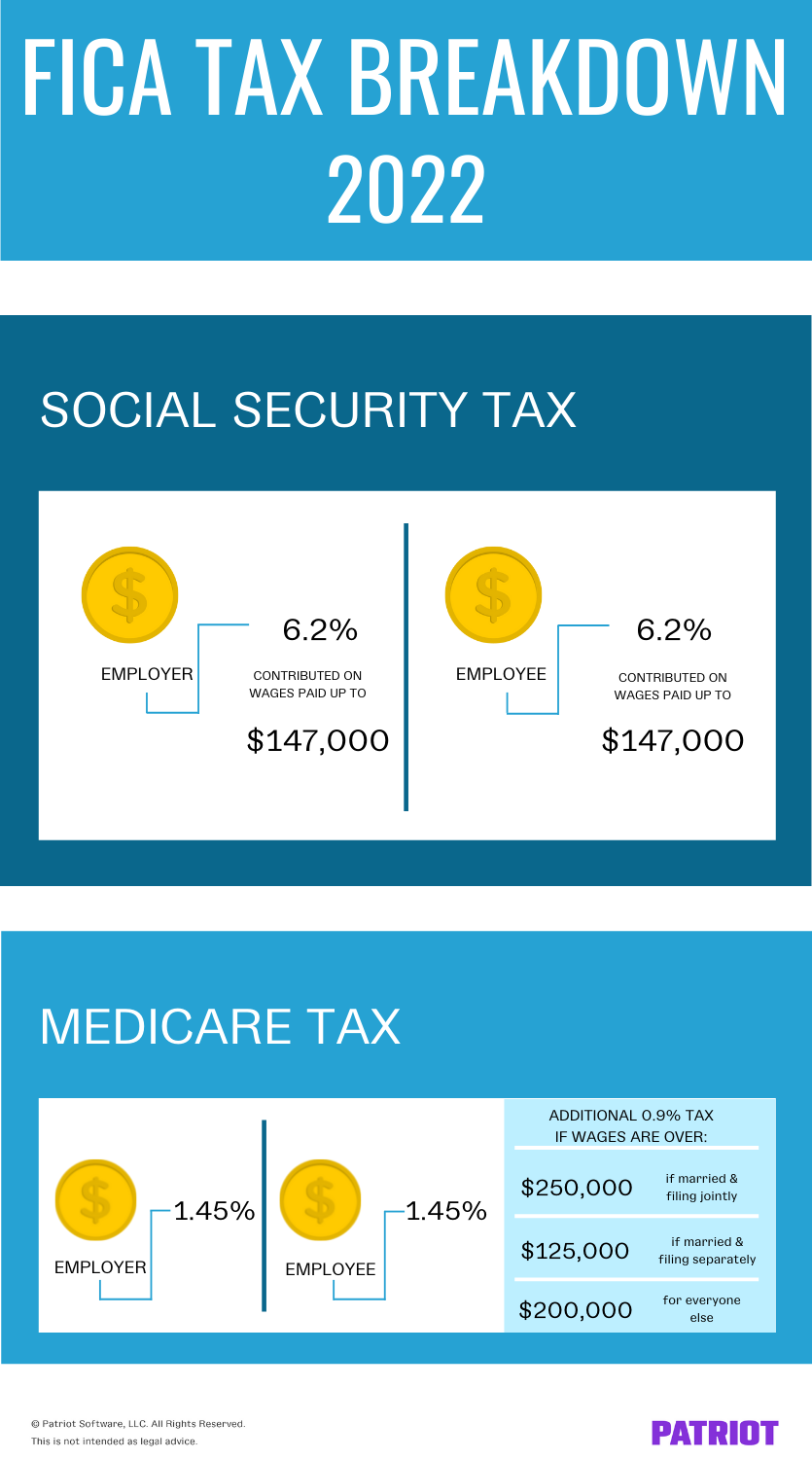

FICA taxes include a 124 Social Security tax although income isnt taxed beyond a certain threshold. 50000 x 09 0009 450.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

The Tax Withholding Estimator compares that estimate to your current tax withholding and can.

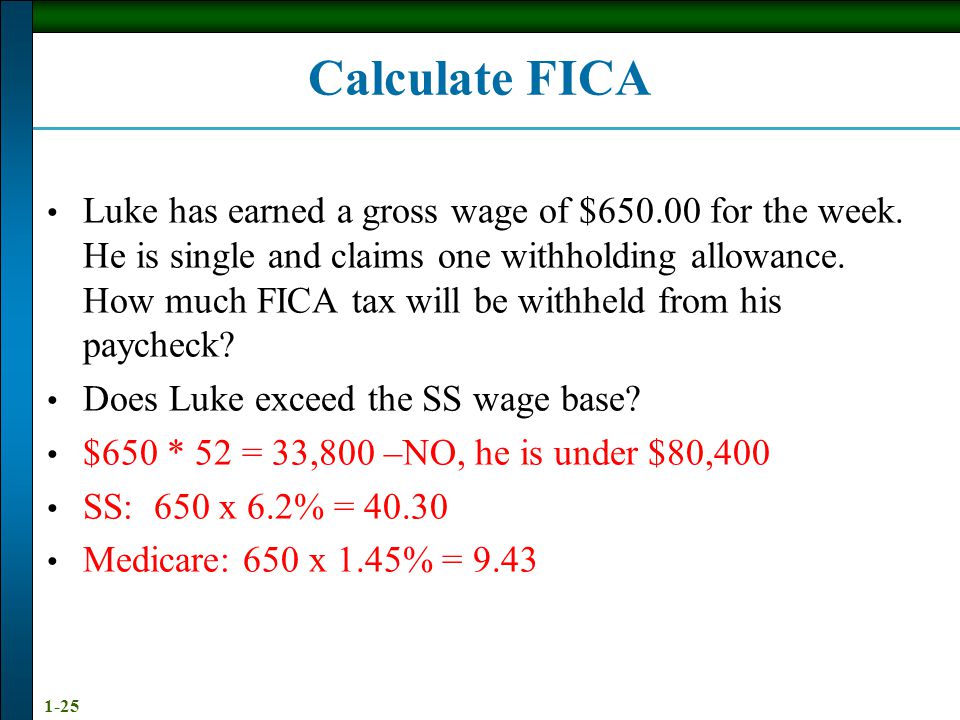

. To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145. 145 Medicare tax withheld on all of an employees wages. Estimate your paycheck withholding with our free W-4 Withholding Calculator.

These tax calculations assume that you have all earnings from a single employer. Deduct federal income taxes which can range from 0 to 37. How Contributions are Calculated.

Social Security taxes. The aforesaid FICA tax calculator is based on the simple formula of multiplying the gross pay by the Social Security and Medicare tax rates. Social Security and Medicare Withholding Rates.

It is possible to have been overwithheld for OASDI FICA taxes in the event that the total of all W2 earning. See how your refund take-home pay or tax due are affected by withholding amount. Different rates apply for these taxes.

Since the rates are the same for employers and. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. FICA taxes also include a 29 Medicare tax and high-income individuals.

The tool is intended to help you complete Form W-4 to adjust the amount of federal income tax to have withheld from your wages. Occupational Disability and Occupational Death Benefits are non-taxable. Use this tool to.

250000 x 145 00145 3625. 147000 x 62 0062 9114. Social security deductions are the responsibility of both the employer.

For example if an employees taxable wages are 700. Form W-4 does not address FICA or Medicare. 2022 social security withholding information.

You can use the Tax Withholding Estimator to estimate your 2020 income tax. The FICA for Federal Insurance Contributions Act tax also known as Payroll Tax or Self-Employment Tax depending on your employment status is your. Employers remit withholding tax on an employees behalf.

This calculator is a tool to estimate how much federal income tax will be withheld from your gross monthly check. 62 Social Security tax withheld from the first 142800 an employee makes in 2021. Subtract any post-tax deductions.

Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand. For example The taxable wages of. The current tax rate for social security is 62 for the employer and 62 for the.

To calculate FICA tax contribution for an employee multiply their gross pay by the Social Security and Medicare tax rates. Estimate your federal income tax withholding. Withholding information can be found through the IRS Publication 15-T.

There is an income cap of 147000 for FICA withholdings. It is possible to have been overwithheld for OASDI FICA taxes in the event that the total of all W2 earning from.

Paycheck Calculator Take Home Pay Calculator

Easiest 2021 Fica Tax Calculator

Easiest 2021 Fica Tax Calculator

Fica Tax 4 Steps To Calculating Fica Tax In 2022 Eddy

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Payroll Taxes Methods Examples More

Excel Business Math 34 Median Function For Fica Social Security Medicare Payroll Deductions Youtube

Chapter 9 Payroll Mcgraw Hill Irwin Ppt Download

Paycheck Calculator Take Home Pay Calculator

Social Security Tax Calculation Payroll Tax Withholdings Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

How To Calculate Find Social Security Tax Withholding Social Security Tax Rate Explained Youtube

What Is Social Security Tax Calculations Reporting More

Enerpize The Ultimate Cheat Sheet On Payroll

Federal Income Tax Fit Payroll Tax Calculation Youtube

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software